research

mindsets

We found out that personas would be a very broad approach to define the audience so we come up with mindsets when we realized that a client can navigate between diferent mindsets due to life happenings.

the real problem

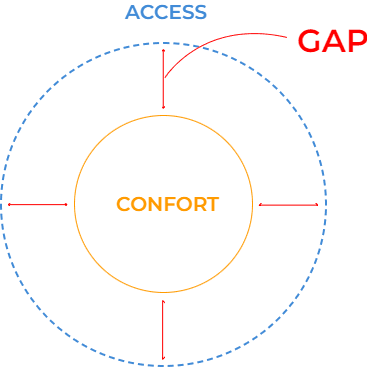

When we merged the user needs with business reality we could see clearly the real problem here.

While the Carrefour’s bank offers credit, a mean to have ACCESS to buy everything they need, we found out that our clients need help to take care of the finances. It could be by helping to organize and keep track or to avoid debits. We named it as CONFORT.

SCoping

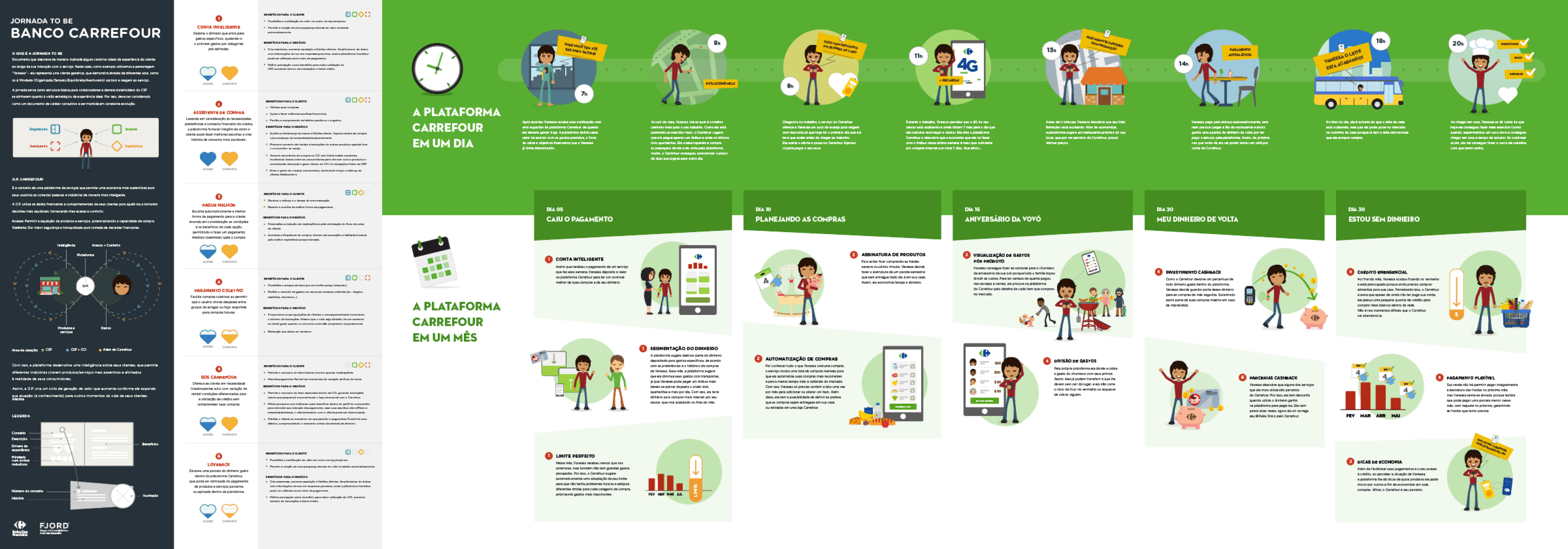

The user journey As Is have 4 big steps, each one divided into his own interactions Awareness, Acquisition, Use and administration. But to really fill the gap we realized that we should act in few steps before so introduced the Planning and Find Offers. With that in hand we could illustrate and have a clear vision of the impact we could make.

Analysis

Considering the user and business needs, after a co-creation section with stakeholders, we designed the future of Bank’s Carrefour experience based in 2 user tasks. To have an idea of potential we created tasks thinking about a daily story use and a monthly story.

user task

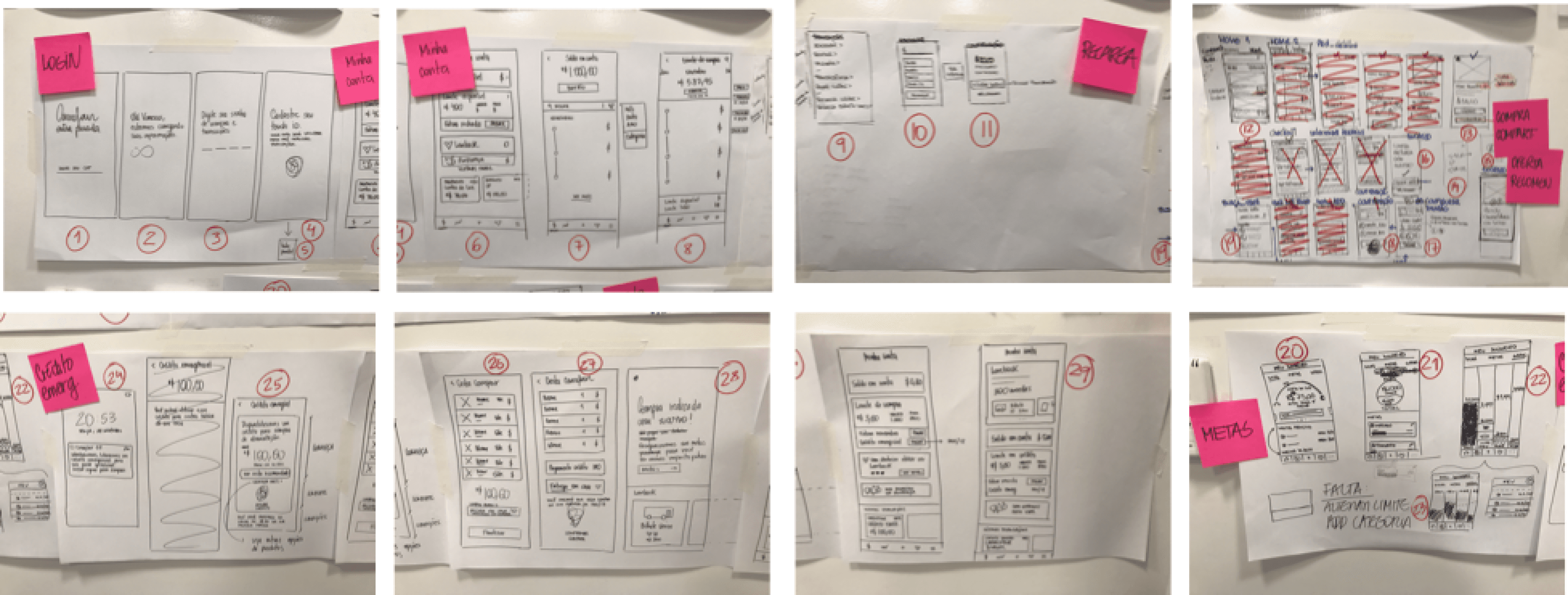

We defined an user task to have a path to build the functionalities, at this point we could have an idea of how to connect the service concepts in a product.

prototypes

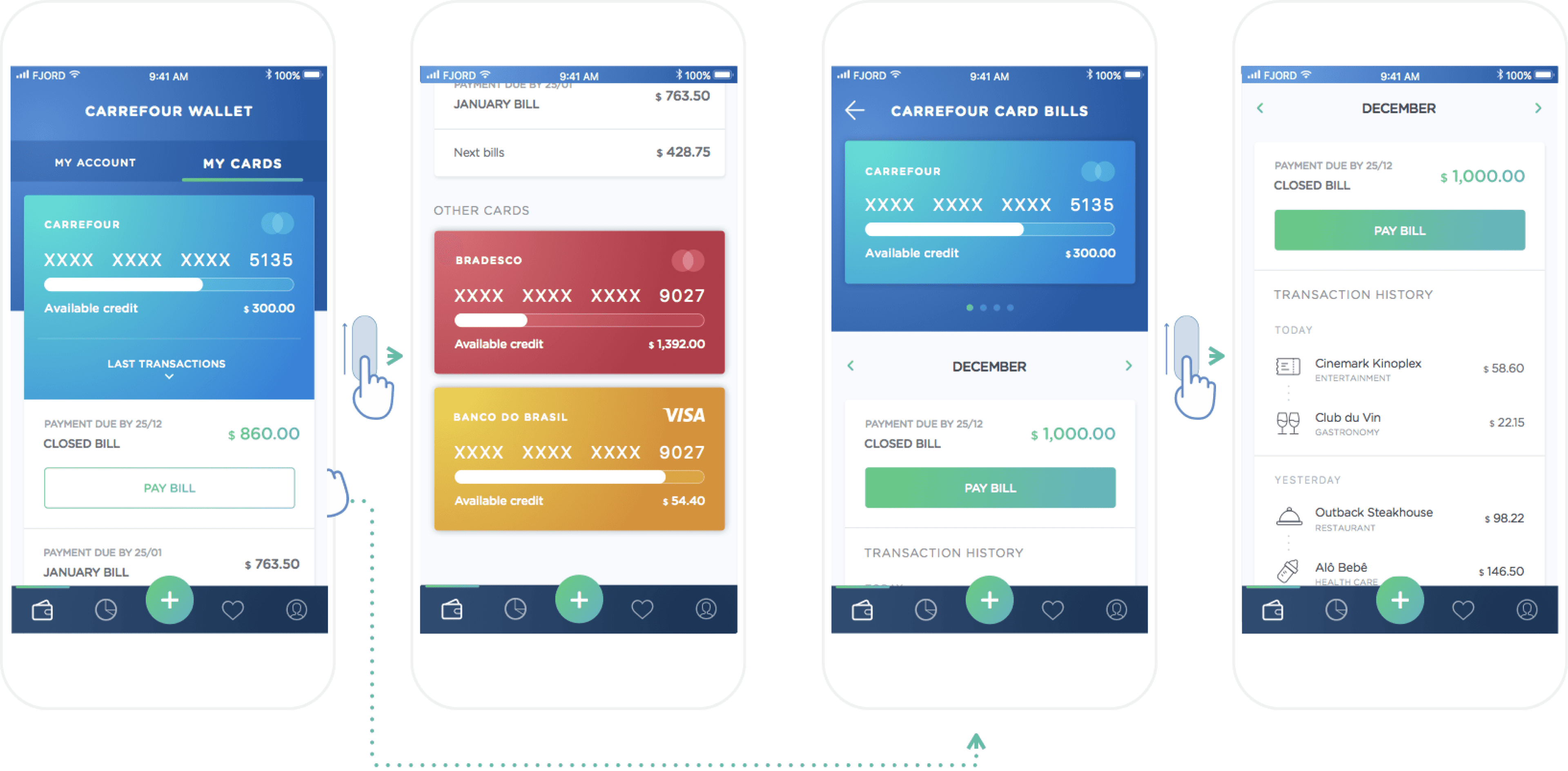

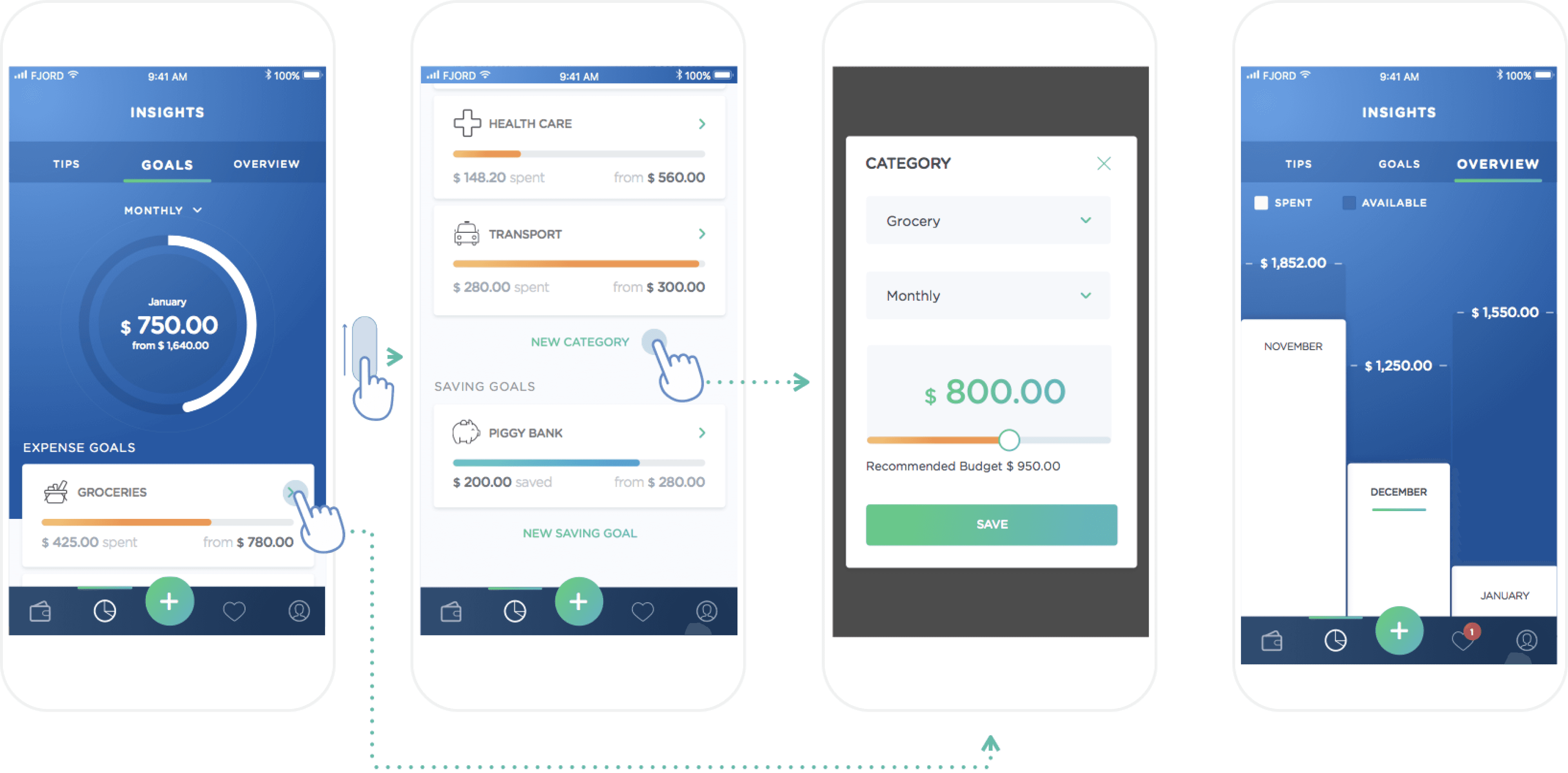

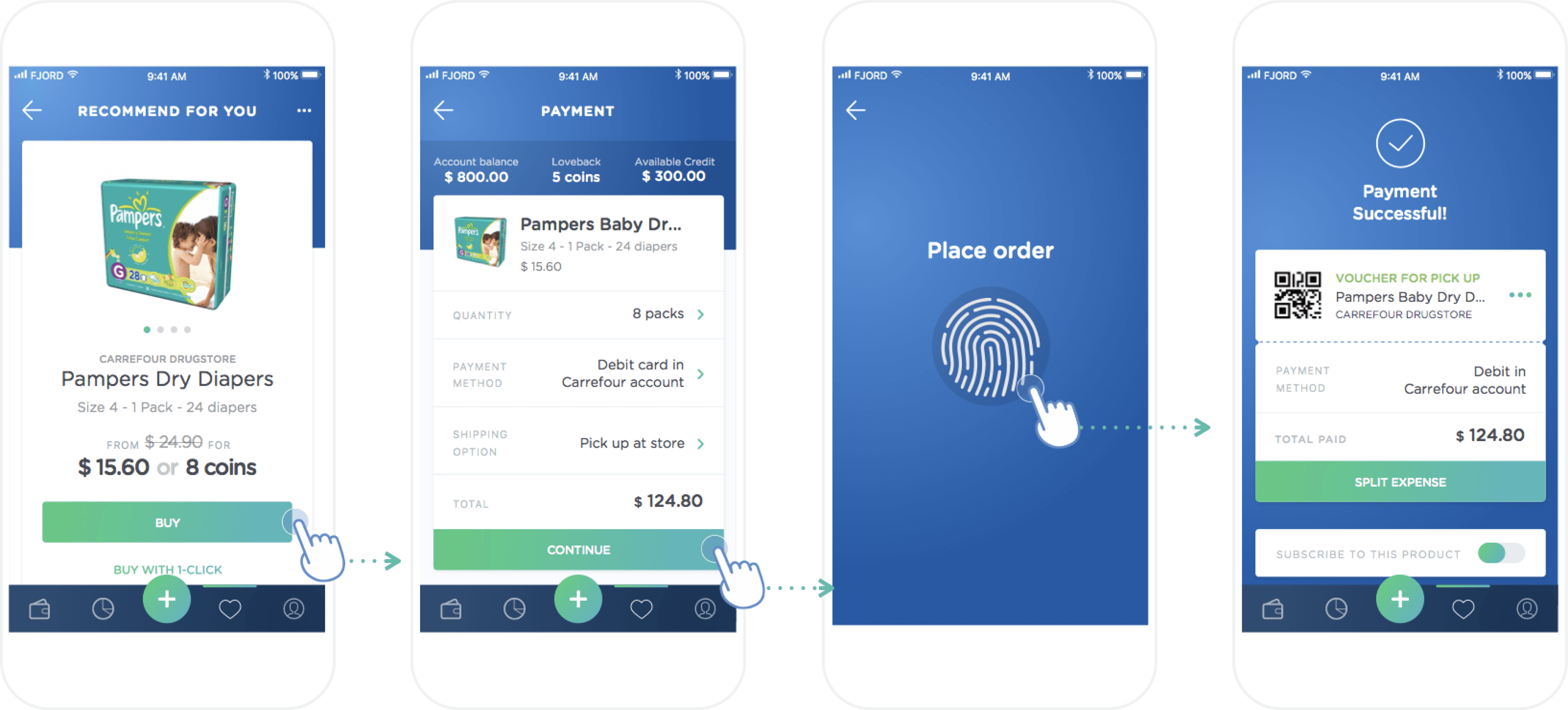

After defining the macro steps in mind we could break into more specific funcionalities and define the small interactions of the product.

CURRENT SCENARIO

design drivers

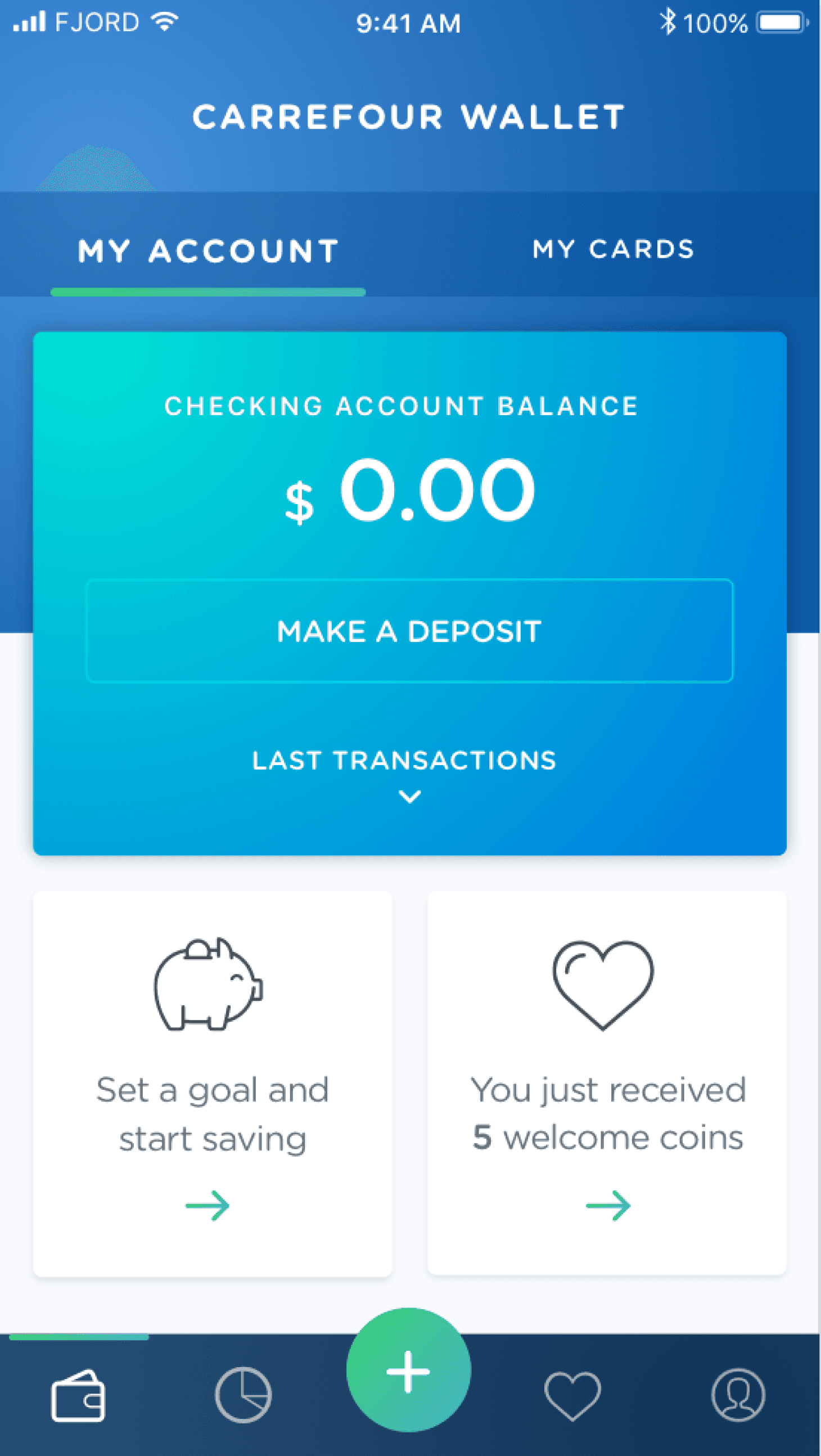

Based on the users mindsets we focused the design in 3 pillars.

Simplicity

Visual elements and communication, making interactions easy to use and understand.

Fluid

Focus

Help users to find the information needed when they need.